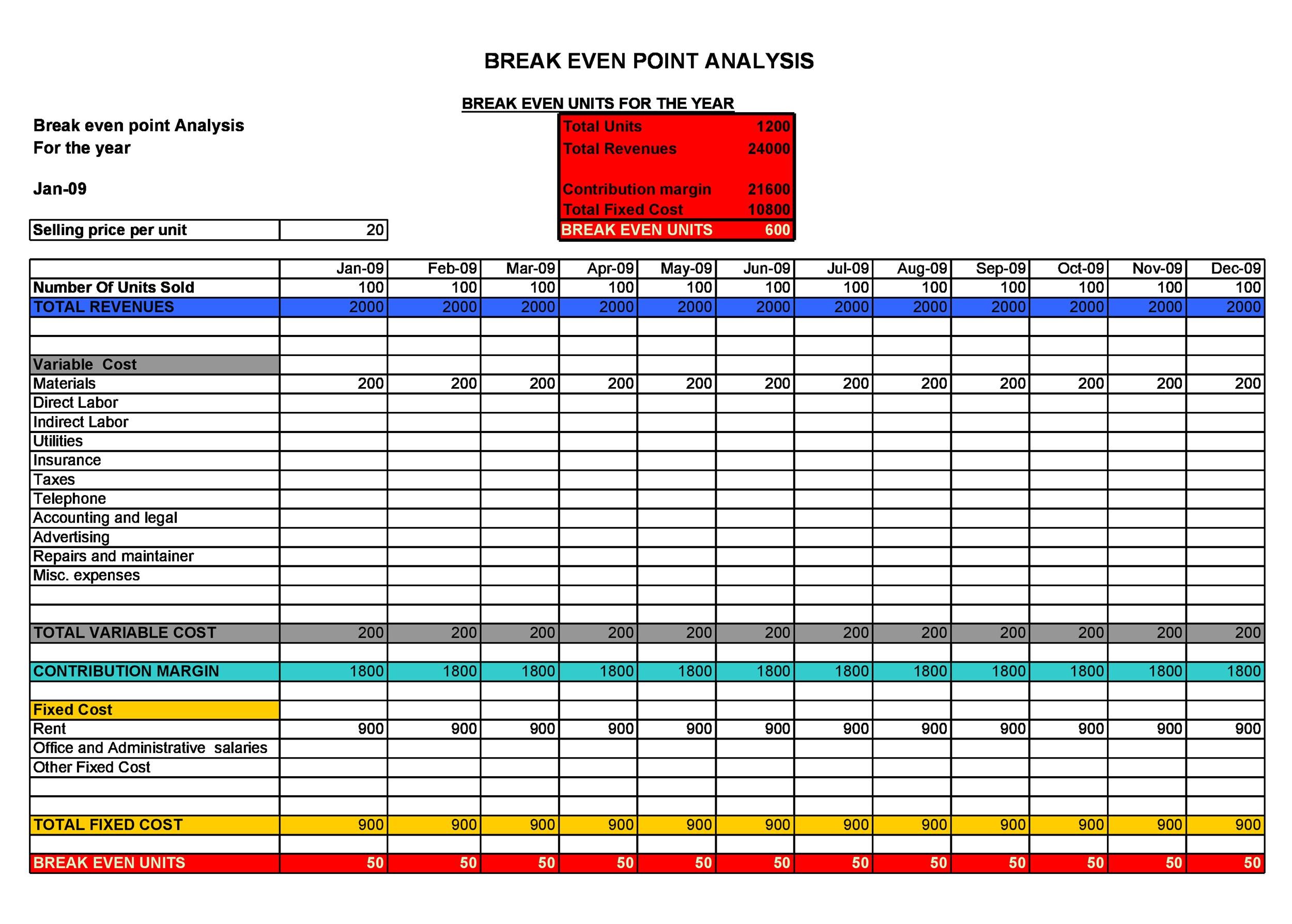

Production managers and executives have to be keenly aware of their level of sales and how close they are to covering fixed and variable costs at all times. That’s why they constantly try to change elements in the formulas reduce the number of units need to produce and increase profitability. In accounting terms, it refers to the production level at which total production revenue equals total production costs.

Break Even Point Calculation Example (BEP)

Another way to reduce fixed costs is to cut back on rent, either by negotiating for better rates, moving to a smaller and/or less expensive space, or shifting to a partly or all-remote working model. This last option could help the business save money on rent, as well as on taxes, insurance, utilities, and so forth. For example, before even sending an order to a factory, you can already know how many units you need to sell and what expenses will go into making that product. Understanding this is key whether you’re launching a business for the first time or starting a new product line. The break-even formula can help calculate the break-even point of your business in terms of product units or sales numbers.

- First, let us give you a brief idea of what these numbers from General Motors’s Annual Report (or 10K) signify.

- In conclusion, just like the output for the goal seek approach in Excel, the implied units needed to be sold for the company to break even come out to 5k.

- We believe everyone should be able to make financial decisions with confidence.

- A break-even analysis determines how much revenue must come in to cover the business’s expenses.

- The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies.

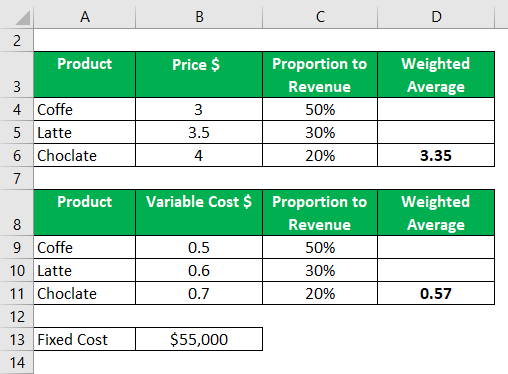

Assumption of Constant Costs

Consequently, understanding where this point lies can inform the setting of strategic objectives and the planning of operational tactics. At its core, break-even analysis provides critical insight into the relationship between costs, volume, and profits. It allows businesses to determine the minimum output they need to achieve to cover all their costs and begin making a profit. First we need to calculate the break-even point per unit, so we will divide the $500,000 of fixed costs by the $200 contribution margin per unit ($500 – $300). First we take the desired dollar amount of profit and divide it by the contribution margin per unit.

Appropriately price your products/services

Small businesses that succeeds are the ones that focus on business planning to cross the break-even point, and turn profitable. Upon doing so, the number of units sold cell changes to 5,000, and our net profit is equal to zero. In effect, the insights derived from performing break-even analysis enables a company’s management team to set more concrete sales goals since a specific number to target was determined. Now it is very easy to calculate the breakeven and to use the formula defined at the beginning of the break-even analysis case study.

When it comes to stocks, for example, if a trader bought a stock at $200, and nine months later, it reached $200 again after falling from $250, it would have reached the breakeven point. The contribution margin represents the revenue required to cover a business’ fixed costs and contribute to its profit. With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit.

Can break-even analysis be applied to service-based businesses?

Let us understand the concept of break even analysis method with the help of some suitable examples. In the first approach, we have to divide the fixed cost by contribution per unit i.e. It’s about costs that come back every month and stay the same, and can only change after a year.

This will give you revenue in sales dollars essential to reach break-even. Especially for a small business, you should still do a break-even analysis before starting or adding on a new product in case that product is going to add to your expenses. There will be a need to work out the variable costs related to your new product and set prices before you start selling. Every business must develop a break-even point calculation for their company. This will give visibility into the number of units to sell, or the sales revenue they need, to cover their variable and fixed costs. The break-even point can be affected by a number of factors, including changes in fixed and variable costs, price, and sales volume.

The result could be an under-priced product and a company that struggles to keep its books in the black. Break-even analysis can help you identify that situation so you can rectify it. You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website.

Did you know that 30% of operating small businesses are losing money? You have to plan ahead carefully to break-even or be profitable in the long run. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption the better way to record prepayment amortisation in xero or exclusion from registration requirements. An unprofitable business eventually runs out of cash on hand, and its operations can no longer be sustained (e.g., compensating employees, purchasing inventory, paying office rent on time). If the price stays right at $110, they are at the BEP because they are not making or losing anything.